Table of Contents

- Evaluating Lemonade’s renters insurance – the 7 factors to consider

- How expensive is Lemonade renters insurance?

- What does Lemonade renters insurance cover?

- Can you bundle Lemonade renters insurance with other policies?

- How easy is it to buy a policy and file a claim?

- What are Lemonade’s consumer satisfaction ratings?

- Is Lemonade financially stable?

- Does Lemonade operate in your state?

- Recap: Should you choose Lemonade renters insurance?

- Lemonade renters insurance: Our final rating

- What about Lemonade’s business model?

Evaluating Lemonade’s renters insurance – the 7 factors to consider

Founded in 2015, Lemonade is a newcomer to the renters insurance industry, and they’ve received a lot of attention for their business model and their tech-driven approach to insurance. In this review, we’ll explain how Lemonade differs from other major insurers, and whether their approach is right for you.

When evaluating Lemonade’s renters insurance, you need to consider seven questions:

- How expensive is Lemonade renters insurance?

- What does Lemonade renters insurance cover?

- Can you bundle Lemonade renters insurance with any other policies?

- How easy is it to buy a policy and file a claim?

- What are Lemonade’s consumer satisfaction ratings?

- Is Lemonade financially stable?

- Does Lemonade provide renters insurance in your state?

Because Lemonade spends most of their resources on their mobile app, which cuts costs by automatically handling claims, they measure up well against their competitors when it comes to price and convenience. However, their customer service is lacking.

How expensive is Lemonade renters insurance?

Lemonade’s renters insurance policies are cheaper than the industry average — most of the time.

We conducted a survey of every major insurer and found that the average price of renters insurance was around $20 per month, slightly higher than the commonly cited figure of $15. Lemonade’s policies, by contrast, cost about $13.79 per month on average.

Lemonade’s prices are surprisingly variable

However, this average is a bit misleading because Lemonade’s prices were more variable than other insurers we looked at.

For example, in Detroit, MI, we received several renters quotes that exceeded $150 per month. By contrast, in Lansing, MI, less than two hours away, Lemonade offers renters insurance for around $26 per month. In neighboring Illinois, the average price was just $8 per month.

The cost of renters insurance is affected by several factors, most significantly weather and crime. Given Detroit’s high crime rate, it isn’t surprising that Lemonade’s policies are more expensive there — but we didn’t expect that much variation. This is by far the widest range we’ve seen from any insurance company anywhere in the country.

The bottom line is that Lemonade’s prices are good, but unpredictable. If you receive a quote from them that seems surprisingly high (anything over $30 per month), shop around and see if other providers offer renters insurance more cheaply in your area. Odds are, they do.

Takeaway: Overall, we found that Lemonade’s prices were better than average, except in a few neighborhoods where they were shockingly high.

What does Lemonade renters insurance cover?

Most renters insurance policies provide the same four types of coverage:

- Personal property coverage: If your possessions are stolen or destroyed by a covered peril, such as fire or hail, your Lemonade will reimburse you for your financial loss. However, you’ll have to pay a small portion of the cost yourself, referred to as your renters insurance deductible.

- Personal liability coverage: If you’re held liable for injuring someone or damaging their property, Lemonade will pay for your legal defense and any damages the injured party is awarded.

- Guest medical coverage: If someone is hurt or gets sick in your home, Lemonade will also pay some of their medical bills, even if you weren’t held liable.

- Loss-of-use coverage: If a covered peril forces you to temporarily leave home (like a hailstorm that destroys your roof and renders your home uninhabitable until it’s fixed), Lemonade will pay for your hotel stay and other additional living expenses until you can move back in.

Lemonade offers essentially the same renters insurance coverage as their competitors — again, most providers are pretty similar in this respect. Notable aspects of their coverage include:

Lemonade offers replacement cost coverage

Lemonade only writes replacement cost policies, which provide much more protection than actual cash value policies. This is a definite plus, as we always recommend getting a replacement cost policy if your insurer offers them.

Lemonade offers unusual coverage options in a few states

Lemonade offers several renters insurance policy options that you’ll have a hard time finding anywhere else. For instance, they offer an insurance rider that covers earthquakes, which only a few other providers do. Lemonade used to partner with a company called Palomar Earthquake Insurance to provide this coverage, but recently began writing their own earthquake insurance.

Lemonade is also the only insurer we know of that offers a $0 deductible. Remember, your deductible is the money you have to pay out of your own pocket when you file a property claim. If you choose this option, you’ll never have to consider whether it’s a waste of time to file a claim because you’re not sure whether the payout will exceed your deductible.

The catch is that these coverage options are only available in a few states. Lemonade offers zero-deductible policies in California, Texas, Nevada, and Illinois, and they only offer their earthquake rider in California and Arkansas. If you live somewhere else, Lemonade’s renters insurance coverage is pretty standard.

Takeaway: Overall, we found that Lemonade’s coverage was average.

Can you bundle Lemonade renters insurance with other policies?

If you have another type of insurance, many providers allow you to bundle your renters insurance policy with it for a discount. Lemonade is no exception — they offer a 10% discount on pet insurance if you buy it with renters insurance.

The good news is that a 10% discount is roughly in line with what Lemonade’s competitors offer. The bad news is that relatively few people actually need pet insurance, and they don’t offer discounts on any other type of insurance.

In contrast, most other insurers offer bundling discounts on auto insurance, which is much more common and much more expensive than pet insurance (which means that more people need it and the discount matters more). Lemonade plans to offer auto insurance soon, but until they do, their bundling options are fairly niche.

Takeaway: Overall, we found that Lemonade’s renters insurance bundling options were below average.

How easy is it to buy a policy and file a claim?

Unlike other renters insurance providers, Lemonade handles practically everything online. You can buy your policy and change your coverage options on their website, but to actually file a claim, you need to use their mobile app. Obviously, this means if you’re one of the few holdouts who’s never bought a smartphone, Lemonade isn’t the right insurer for you.

We bought a Lemonade renters insurance policy and tested their app. We found it intuitive and pleasant to use, although Maya, their AI chatbot, was a bit disappointing.

Buying a policy

When you apply for renters insurance on Lemonade’s website, their bot (Maya) gives you a short quiz and then presents you with a quote.

The process is quick and painless. Lemonade’s website is well-designed, and they clearly explain all of the options they present you with.

When you tweak your coverage (e.g. by adding more personal liability coverage or a water backup rider) your quote updates instantly, in contrast to many other insurers who force you to refresh the page each time.

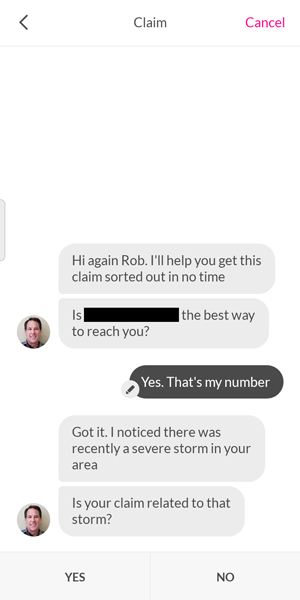

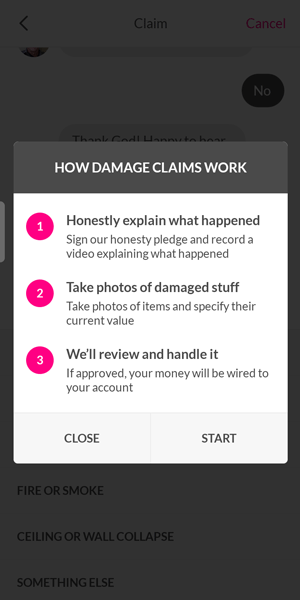

Filing a claim

Lemonade processes all of their claims through their mobile app. We downloaded it and found it to be just as well-designed as their website.

The Claims button is easy to find (it’s in the top right). When you tap it, you’re placed into a chat with another bot, “Jim,” who asks you several questions about what happened — e.g., did somebody get hurt, or did someone’s property get damaged? Was it your property or someone else’s?

Once you answer Jim’s questions, the app asks you to snap a few pictures of the damage and record a short video explaining what happened. All in all, it’s an intuitive process that makes filing a claim easy, and — dare we say it — even a little bit fun.

Lemonade says that it processes 30% of the claims it receives using AI. This means there’s a chance your money will be paid out instantly, although most claims still have to be reviewed by a human being.

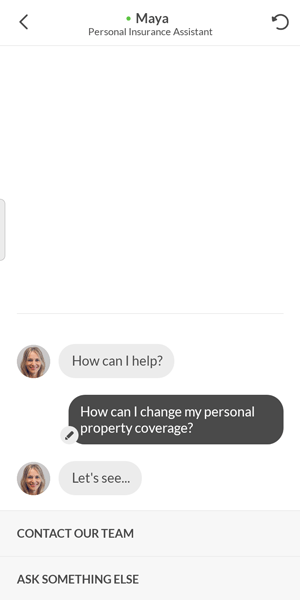

Customer service

In the lower right-hand corner of Lemonade’s app, there’s a button that you can click to open a chat with Maya. If you have any questions about your policy, you can type them and she’ll respond automatically.

Unfortunately, Maya didn’t handle our questions very well, which was surprising given how polished Lemonade’s app is in most other respects. We asked Maya a series of easy questions, including:

- How can I add more personal property coverage to my policy?

- How do I purchase water backup coverage?

- Does my policy cover earthquakes?

- How can I change my Giveback charity? (more on what this means later)

In every case, Maya responded with “Let’s see …” and then offered to refer our question to Lemonade’s support staff:

We took her up on that, and instead of instantly being connected with a representative, we were told we’d receive a reply via email.

Obviously it isn’t reasonable to expect automated bots to answer complicated questions, but we deliberately kept ours very simple, and it was disappointing to have to wait for an answer. For even more negative points, Maya referred to Lemonade’s customer service reps as “coverage ninjas.”

Takeaway: Although Maya was disappointing, overall we found Lemonade’s user experience to be above average.

What are Lemonade’s consumer satisfaction ratings?

Our own experience with Lemonade is obviously anecdotal, so to get an idea of what their other customers think, we looked at three metrics of consumer satisfaction: Lemonade’s J.D. Power rating, their NAIC complaints, and their Better Business Bureau customer reviews.

Lemonade’s J.D. Power rating: 866/1000 (significantly above average)

The market research firm J.D. Power conducts a yearly survey of the customers of major insurance companies. J.D. Power asks customers how they would rate their insurer in various categories, including customer service, claims handling, and pricing.

In J.D. Power’s 2020 survey, Lemonade’s total score was 866 — the second-highest score overall. The highest rating was 888 (awarded to USAA renters insurance, which is only available to military families) and the average score was 839.

Lemonade’s NAIC complaints: 6 (worse than average)

The National Association of Insurance Commissioners (NAIC) received 6 complaints about Lemonade’s renters insurance in 2020.

That number might look small, but it’s actually relatively high compared to Lemonade’s competitors, especially given Lemonade’s small customer base.

In December, 2020, Lemonade announced that they had around one million customers. That’s respectable, but in contrast, other, established insurers like Progressive, Liberty Mutual, and Allstate all have tens of millions of customers, and received just 1–3 renters insurance complaints each. This makes Lemonade’s 6 NAIC complaints puzzling and a bit concerning.

Lemonade’s Better Business Bureau customer reviews: 4.3 (significantly above average)

Lemonade has an average customer rating of 4.3 out of 5 stars on the Better Business Bureau’s website. (The BBB themselves gave Lemonade a letter grade of “C”, which isn’t very good, but we suggest not paying attention to that — the BBB’s ratings aren’t very reliable.)

Breaking down Lemonade’s score

4.3 stars is astoundingly high for an insurance company. By way of comparison, State Farm’s score is 1.3, and Travelers’ is a whopping 1.18. (Insurers tend to have low scores because dealing with insurance is stressful and people are more likely to leave reviews when they’re unhappy.)

Lemonade’s score is so high that it frankly made us suspicious, but their reviews seem to be genuine. However, we noticed that the majority of their 5-star reviews were dated 2019 or earlier. Most of their reviews from 2020–2021 are negative.

Reading Lemonade’s 1-star reviews, we noticed a few recurring themes:

- Claims handling: If Lemonade handles your claim automatically, you can expect to receive your payout quickly, with no hassle. On the other hand, if Lemonade refers your claim to an insurance adjuster, the process might turn into a nightmare.

- Customer service: If you need to speak with someone about your policy or claim, good luck. It’s very difficult to get Lemonade’s customer service reps on the phone.

We’re inclined to believe these complaints. They’re backed up by other first-hand customer reviews we’ve read online, and they make sense given Lemonade’s business model. (Lemonade heavily relies on automation to compensate for their small staff.)

Takeaway: Overall, Lemonade’s consumer reviews are significantly better than average. But be careful — they do have a number of recent negative reviews which we find credible.

Is Lemonade financially stable?

As an insurance startup, Lemonade’s long-term financial outlook is uncertain. They haven’t been around long enough to receive an AM Best rating, which is a measure of creditworthiness, and although Lemonade received a Demotech Financial Stability rating of “A (Exceptional)”, we’re usually skeptical of Demotech’s scores. What’s more, unlike their more-established competitors, Lemonade has never once turned a profit.

That sounds bad — but it’s important to realize Lemonade has never really tried to turn a profit. Like many young companies, right now they’re focused on expanding as quickly as possible and plan to worry about profitability later.

Is that something that you, the customer, need to worry about? Unfortunately, there’s no easy answer. Lemonade’s financial health affects their ability to pay out insurance claims, but there are a lot of fail-safes built into the insurance industry that limit your risk. Like all insurance companies, Lemonade works with reinsurers (insurers who insure other insurers — yes, we know), and they’re backed by your state insurance guaranty association, who will step in and make sure you get your money even if your insurer goes bankrupt.

However, Lemonade’s finances can indirectly affect your experience as a customer. For example, if they struggle financially, they might try to cut costs by being stingier with claims, raising your premiums, or by downsizing their customer support staff.

In general, Lemonade’s financial situation isn’t precarious enough for us to warn you away from them, but we do recommend keeping an eye on it. You can always switch to another insurer in a few years if they end up struggling.

Takeaway: Lemonade’s financial stability is uncertain. We recommend keeping an eye on it.

Does Lemonade operate in your state?

Lemonade is a newcomer to the insurance scene, and they don’t operate in every state yet. As of June, 2021, Lemonade offers renters insurance in 27 states and the District of Columbia.

States covered by Lemonade’s renters insurance

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Georgia

- Illinois

- Indiana

- Iowa

- Maryland

- Massachusetts

- Michigan

- Missouri

- Nevada

- New Jersey

- New Mexico

- New York

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- Tennessee

- Texas

- Virginia

- Washington (state)

- Washington, DC

- Wisconsin

If Lemonade doesn’t operate in your state, you’ll need to get a different renters insurance provider until they expand there.

Recap: Should you choose Lemonade renters insurance?

Lemonade’s tech-driven approach is unusual. If you like handling things online, it might really appeal to you, but it’s definitely not for everybody.

Lemonade: Advantages

- Lemonade’s prices are usually better than their competitors, although there are a few notable exceptions.

- Lemonade offers several very unusual coverage options, such as a $0 deductible. However, they don’t offer those in every state.

- Lemonade’s website and mobile app are top-notch, and actually make getting insurance fun.

Lemonade: Disadvantages

- Lemonade’s customer service is lacking. It’s very hard to get in touch with reps over the phone.

- Maya, Lemonade’s chatbot, doesn’t handle questions very well.

- Lemonade doesn’t have a very long track record, and there’s no way to know whether they’ll perform well in the future.

Why should you choose Lemonade’s renters insurance?

- You strongly prefer handling claims online: If you’re phone-averse (like a lot of young people), you’ll love Lemonade’s online-only claims handling.

- Cost is your biggest concern: It depends on where you live, but there’s a good chance Lemonade is your cheapest renters insurance option.

Why shouldn’t you choose Lemonade’s renters insurance?

- You prefer to deal with human beings: If you’re worried about not being able to speak with an agent or representative (which is reasonable when it comes to sensitive issues like insurance claims) then you should sign up with a company with better customer service, like State Farm or Allstate.

- You have or need auto insurance: If you have auto insurance with another provider, look into bundling your renters insurance policy with it. Bundling offers significant discounts, and you’ll probably be able to get a better deal than Lemonade can offer you.

Lemonade renters insurance: Our final rating

Overall, we rate Lemonade’s renters insurance three stars out of five. (3/5)

What about Lemonade’s business model?

One final note: As we said above, Lemonade has received a lot of attention for their business model, which they call peer-to-peer (P2P) insurance.

What is peer-to-peer insurance? Honestly, in Lemonade’s case, it’s mostly just marketing hype. In true P2P insurance models, you pay money into a pool which you share with other people, and withdraw from it if disaster strikes. Essentially, P2P insurance is a system where a group of “peers” insure each other.

Conversely, in Lemonade’s model, you pay money to Lemonade, and when you file a claim, they pay you from their cash reserves, the same way every other insurer does. Ultimately, Lemonade’s model really isn’t that different from their competitors, and it’s neither a selling point nor a negative.

Lemonade donates some of your money to charity

However, Lemonade’s business model has a twist: when you sign up for an insurance plan, they ask you to pick a charity to support.

Lemonade places you in a group of people who picked the same charity. (The existence of these groups is what lets them claim their model is peer-to-peer.) Every year, Lemonade takes some of the profits they earned from your peer group and donates them to the charity that you chose.

We didn’t factor this into our rating of Lemonade; we chose to focus on how good their renters insurance was, and not on how much good they do out there in the world.

Still, it’s obviously nice to know that some of your money will be going to charity, and we commend them for it. (For what it’s worth, our charity was the Humane Society.)

Related Questions

- What is guest medical coverage in renters insurance?

- What is a sub-limit in renters insurance?

- Does renters insurance cover home-based businesses?

- Does renters insurance cover gold or silver bullion?

- What does "dependent in the care of" mean in renters insurance?

- Does State Farm renters insurance cover hotel stays?