Table of Contents

Renters insurance doesn’t cover earthquakes (by default)

Earthquakes are an excluded peril, which means standard renters insurance policies don’t cover them. So are most damages relating to “earth movement,” such as landslides, sinkholes, and liquefaction.

Renters insurance also doesn’t cover earthquake damage to your building (that’s your landlord’s responsibility) or to your car (your auto insurance should take care of that). However, sometimes you can add coverage by purchasing an earthquake rider.

What is an earthquake rider for renters?

If you’ve read our post on what renters insurance is, you know that you can expand your coverage to include additional perils like earthquakes by purchasing something called a rider or endorsement.

What does an earthquake rider cover?

Insurance companies that offer earthquake riders will cover your personal property if it’s damaged by an earthquake or reimburse you if you need to temporarily move out.

Aftershock damage

An earthquake rider will cover your personal property from both the actual earthquake and the aftershocks. However, there’s usually a time limit, after which the aftershocks are no longer covered. For example, Liberty Mutual’s earthquake rider provides coverage for damage that occurs up to 360 hours after the initial earthquake.

Not all insurers offer earthquake riders, and they aren’t offered in every state. If you want earthquake coverage, you may have to purchase a separate earthquake insurance plan instead.

Do renters need earthquake insurance?

Earthquake insurance isn’t mandatory, and most earthquakes cause little-to-no damage. However, some are extremely destructive. If you live in an earthquake-prone area and would struggle to replace all of your possessions out-of-pocket, you should strongly consider buying earthquake insurance.

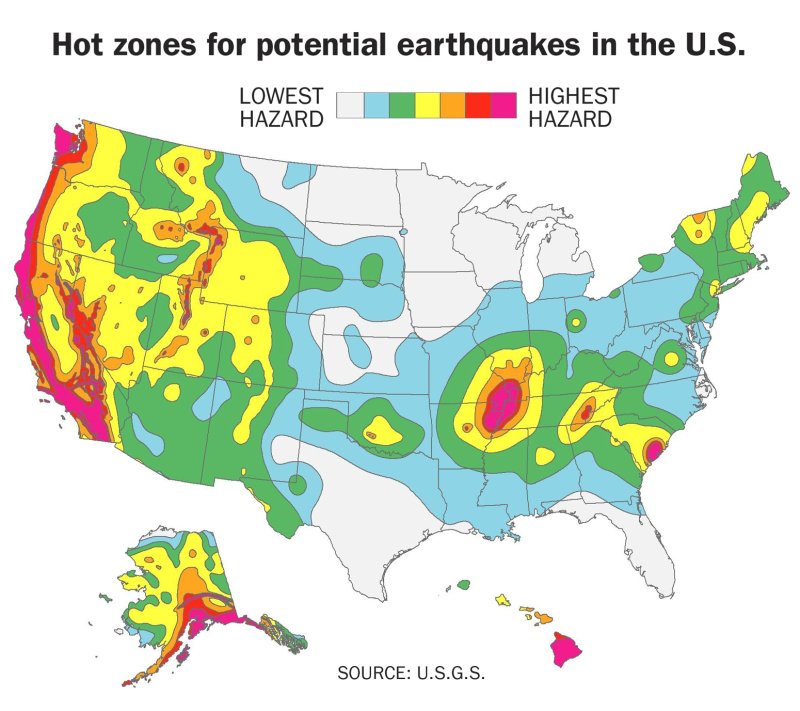

To consider if an earthquake rider or earthquake insurance is worth it for you, you can refer to the map below to determine the probability of an earthquake happening in your area:

It’s almost always worth getting earthquake insurance if you’re buying renters insurance in California or another state with several “highest hazard” zones, such as Washington or Oregon.

Related Questions

- What is guest medical coverage in renters insurance?

- What is a sub-limit in renters insurance?

- Does renters insurance cover home-based businesses?

- Does renters insurance cover gold or silver bullion?

- What does "dependent in the care of" mean in renters insurance?

- Does State Farm renters insurance cover hotel stays?