Table of Contents

Are receipts mandatory when filing a renters insurance claim?

No, receipts aren’t mandatory when filing a renters insurance claim, and you don’t need to worry if you don’t have them. Insurers realize that most people throw most of their receipts away, and they’re used to evaluating claims without them.

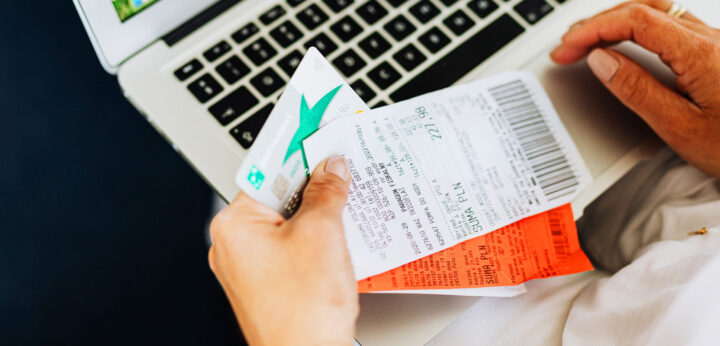

However, if you do have receipts, they’ll make it very easy to document your item’s cost and prove that you were the owner. If you don’t, you’ll need to provide this evidence in a different way when you fill out a proof of loss document.

What is proof of loss?

Proof of loss is a document that you fill out when you file a renters insurance claim for property loss or damage. The proof-of-loss form asserts that the damaged property was yours, as well as how much it was worth.

When you provide this document (which is sometimes an actual, physical paper, but these days is just as likely to be a digital form), your insurer will ask you to attach any documentation you have, such as receipts, which they’ll use to evaluate your claim.

I don’t have receipts. What other documentation can I use?

Insurance companies understand that most people don’t save their receipts, so they accept many other types of documentation. Submit as much evidence with your proof-of-loss form as you can.

What counts as evidence when you’re making a claim?

In addition to receipts, you can also provide one or more of the following:

- Bank or credit card statements

- Photos or videos that show the items

- Warranties

- Manuals

- Original packaging

- Emails or texts from friends or family acknowledging your ownership

- Spare parts for the item

Some of those are better than others; bank statements are probably the strongest kind of evidence, followed by photographs of the item before and after the loss. However, any type of evidence is better than nothing.

I don’t have receipts or any other documentation. Will my claim be denied?

If you don’t have any kind of proof of ownership or proof of purchase, your insurer is within their rights to deny your claim.

However, that doesn’t mean you should give up. Explain the situation to your agent. Because most renters insurance property claims are relatively small (measured in hundreds or thousands of dollars) there’s a decent chance your insurer will still be willing to help you recover part of your loss.

Your claim history will play a factor in this. If you haven’t made many prior claims, your insurer is more likely to be lenient.

Note that whether you can provide documentation or not, filing a renters insurance claim will cause your future premiums (the price of renters insurance) to go up. Only file a claim if the damage significantly exceeds your renters insurance deductible and you’d struggle to pay it out of pocket.

How to determine the value of items if you don’t have receipts

If you want to file a claim, you need to know how much your possessions are worth. If you don’t have receipts, there are several ways you can estimate their value.

Refer to your home inventory

When you applied for your renters insurance policy, your insurer probably encouraged you to make a renters insurance home inventory, which should list the approximate value of your important belongings. Refer to your inventory when you file your claim.

Find the market price online

You may be able to find the price of your item online — either the retail price (if you have a replacement cost policy), or the resale value (if you have an actual cash value policy). If you can’t find the exact item, look for similar items and come up with an estimate.

When you do your research, make sure to account for as many features as possible. If you file a claim for a blender and don’t provide any details, your insurer will only pay out enough to buy the cheapest possible replacement. If your blender had an ice crusher and a high-quality steel jar, look for a model with those features and stress them when you explain how you came up with your item’s estimated value.

The phrase to use when you talk to your claims adjuster is like and kind — as in, “I researched blenders and found this like-and-kind replacement selling for $200.” In the insurance industry, “like and kind” is shorthand for an item that’s equivalent to the one you lost, without lacking any features or being lower in quality.

Get an appraisal

If your damaged belongings were particularly expensive, you can hire a professional appraiser to calculate and certify their value. This is especially useful if you need to file a claim for rare items such as:

- Trading cards

- Jewelry

- Paintings

- Antiques

- Collectible stamps

- Coins

You can find an appraiser after contacting your insurer, which you should do as soon as possible. (Many insurers require you to do it within 48 to 72 hours).

To find a trustworthy appraiser in your area, you can search on the websites of the major appraisers’ professional organizations, which include:

- International Society of Appraisers

- American Society of Appraisers

- Appraisers Association of America

- American Gem Society

Not all appraisers behave ethically, so make sure to thoroughly vet them by checking that they’re licensed and that there haven’t been any complaints against them filed with the Better Business Bureau (BBB).

When you contact the appraiser, let them know you need a determination of loss of value (sometimes called a diminished value appraisal). They’ll walk you through the rest of the process.

Related Questions

- What is guest medical coverage in renters insurance?

- What is a sub-limit in renters insurance?

- Does renters insurance cover home-based businesses?

- Does renters insurance cover gold or silver bullion?

- What does "dependent in the care of" mean in renters insurance?

- Does State Farm renters insurance cover hotel stays?